Latest tax updates in Singapore

13 September 2024

JBS Practice Public Accounting Corporation, AGA's accounting representative in Singapore, highlights the latest tax updates in the region.

1. Enterprise Innovation Scheme (EIS)

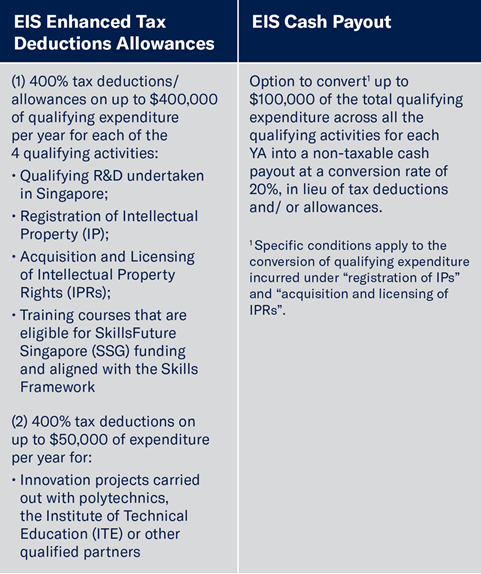

The EIS was announced in Budget 2023. Besides enhancement to existing tax measures and the introduction of a new tax measure, the EIS also enables eligible businesses to opt to convert up to $100,000 of total qualifying expenditure for each Year of Assessment (YA) into cash at a conversion rate of 20%. The cash payout is capped at S$20,000 per YA and it is not taxable. Partial cash conversion is allowed for qualifying R&D undertaken in Singapore, licensing of IPRs, training and innovation projects carried out with polytechnics, the ITE or other qualified partners. Partial cash conversion is not allowed for registration of IPs and acquisition of IPRs. The EIS is available for YA2024 to YA2028.

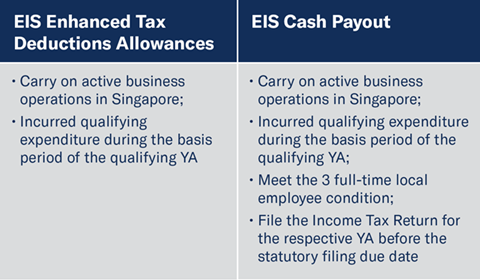

Only sole-proprietorships, partnerships, companies (including registered business trusts), registered branches and subsidiaries of a foreign parent or holding company are eligible for EIS enhanced tax deductions/ allowances and Cash Payout. The qualifying conditions are summarised in the table below:

2. GST InvoiceNow Requirement

GST-registered businesses will be required to transmit invoice data to the Inland Revenue Authority of Singapore (“IRAS”) using InvoiceNow solutions via the InvoiceNow network. This requirement will be implemented progressively:

- From 1 November 2025, for newly incorporated companies that register for GST voluntarily.

- From 1 April 2026, for all new voluntary GST-registrants.

InvoiceNow is the nationwide e-invoicing network based on an international standard called “Peppol”. It was introduced by the Infocomm Media Development Authority (“IMDA”) in 2019. InvoiceNow enables businesses to easily send and receive invoices in a structured digital format. This digital invoicing method reduces the need for manual processing and recording of invoices in accounting systems, which helps businesses avoid tedious work and errors.

To support the nationwide InvoiceNow initiative, and as part of the ongoing transformation efforts to digitalise with the wider ecosystem and integrate tax into taxpayers’ accounting and payroll systems, GST-registered businesses will be required to use InvoiceNow solutions to send invoice data to IRAS for tax administration. Invoices that are not issued using InvoiceNow (e.g. for sales made via point-of-sale systems) should also be recorded in InvoiceNow solutions and sent to IRAS.

A soft launch for early adoption will commence from 1 May 2025, allowing any existing GST-registered businesses that wish to be early adopters to transmit invoice data to IRAS using InvoiceNow solutions via the InvoiceNow network.

There are plans to progressively implement the GST InvoiceNow Requirement for the remaining GST-registered businesses. The IRAS will consult industry partners and carefully review the feedback received before announcing further details.

3. Tracking of foreign income

With effect from the YA 2024, companies are required to provide the following information in their tax computation:-

- Unremitted foreign income brought forward from prior YAs

- Foreign income earned in the current financial year

- Foreign income received in Singapore during the financial year

- Foreign income used during the year and not received in Singapore

- Unremitted foreign income carried forward

- Tracking of allowable expenses attributable to the foreign income if the company is electing for the liberalised treatment of expenses incurred in Singapore

This reporting requirement will ensure that companies keep track of their foreign income and accurately report their taxes when the foreign income is considered received in Singapore. To make it easier for companies to comply with the reporting requirement, IRAS has developed the standard template for companies’ reference.

4. Certificate of Residence (“COR”) Application for Singapore Companies

For COR applications in respect of calendar year 2025 and after, apart from demonstrating that decisions on strategic matters are made in Singapore, the company must also:

- Have at least 1 director based in Singapore who holds an executive position and is not a nominee director;

- Have at least 1 key employee (e.g. CEO, CFO, COO) based in Singapore; or

- Be managed by a related company based in Singapore (e.g. the related company makes the decisions relating to the operations of the foreign-owned investment holding company or reviews the performance of the investments of the company)

The above change is to allow these companies to better substantiate that they have valid reasons for setting up operations in Singapore.

5. Implementation of the Income Inclusion Rule (“IIR”) and Domestic Top-up Tax (“DTT”) in Singapore

Singapore will implement the IIR and a domestic minimum top-up tax (known as “DTT” in Singapore) from businesses’ financial years starting on or after 1 January 2025. The implementation of the Undertaxed Profits Rule (“UTPR”) will be considered at a later stage.

The IIR and DTT will apply to MNE groups with annual revenues of at least €750 million in the consolidated financial statements of the ultimate parent entity (“UPE”) in at least two out of the four financial years immediately preceding the financial year in which the IIR and DTT would apply. For example, in determining whether IIR and DTT would apply to an MNE group in the financial year 2025, the relevant financial years for purposes of applying the revenue threshold would be 2021 – 2024.

About JBS Practice Public Accounting Corporation:

As AGA's accounting member firm in Singapore, JBS PRACTICE PUBLIC ACCOUNTING CORPORATION (“JBS Practice”) is a progressive boutique firm offering audit and assurance services to a diverse range of clients, from large privately held corporations, subsidiaries of listed companies to private businesses, entrepreneurs and individuals across a wide range of industries. Clients operating out of Singapore are mainly from Europe, U.S. and India.

At JBS Practice, the goal is to look beyond numbers and compliance issues, and to provide clients with practical advice to resolve problems and help them achieve their business goals.